Launching a startup is exciting, but managing finances often feels like a nightmare. Many founders still believe that accounting for startups means messy spreadsheets, late-night number crunching, or hiring an expensive accountant once things get serious.

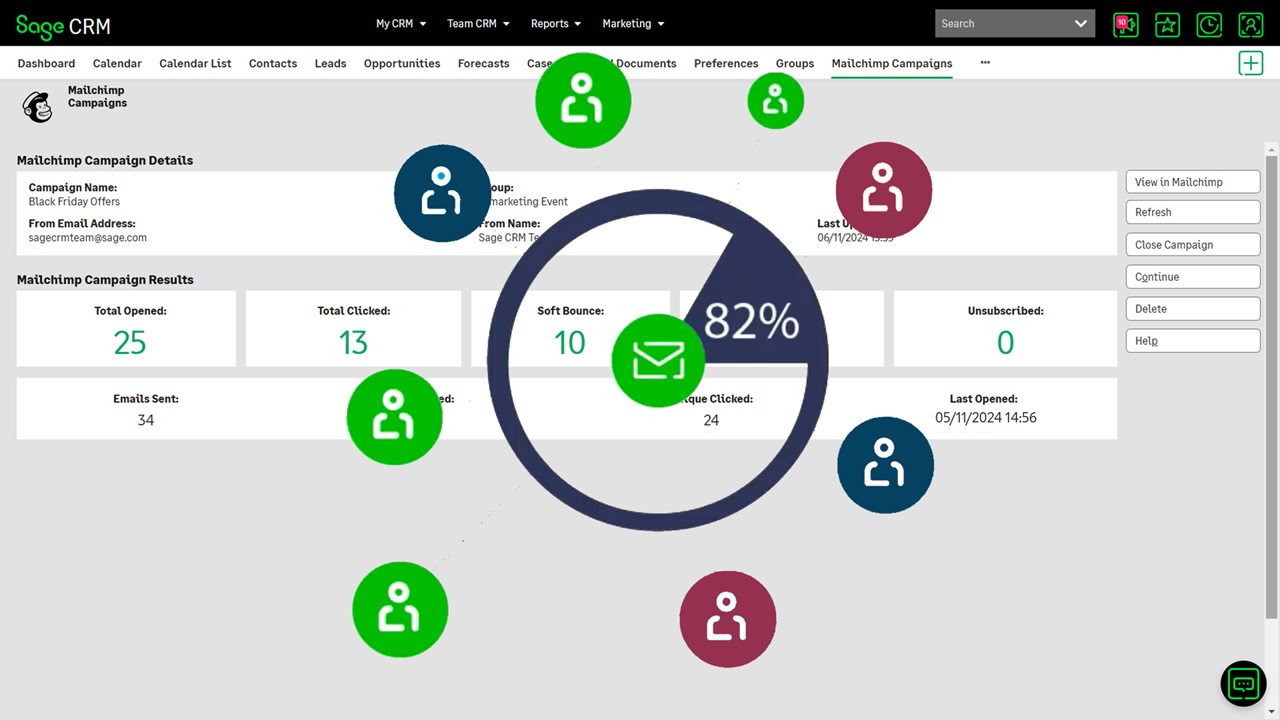

But here’s the thing: 82% of small businesses fail due to poor cash flow management, a problem that the best accounting software for startups can easily help you avoid.

Unlike the outdated tools of the past, modern accounting software is designed to be simple, affordable, and flexible. Whether you are considering cloud-based platforms like Xero or Zoho accounting software, or you are looking for the best accounting software for startups, free to test the waters, there are tools tailored for every budget and stage of growth. These solutions make it easy to send invoices, track expenses, and forecast cash flow, all from your laptop or phone.

In this article, we will share the best cloud accounting software options for startups, including both premium and free options, that we have personally tested or seen small founders successfully utilize. By the end, you will have a clear roadmap to choosing the best accounting software for small startups, so you can stop stressing about spreadsheets and start focusing on scaling your business with confidence. Here’s a quick overview of the accounting software for start-ups:

| Software | Key Features | Pricing | Best for |

|---|---|---|---|

| Xero | Cloud-based, unlimited users, strong reporting, 1,000+ integrations | Plans start at $29/month | Ideal if you are scaling quickly and need unlimited userspowerful integrations, and advanced reporting., |

| Zoho | Easy invoicing, expense tracking, tax compliance, integrates with other Zoho apps | Free plan for businesses available; Paid plans start at $15/month | Perfect for very small startups earning under $50k/year that need basic invoicing, expense tracking, and tax compliance without paying upfront. |

| Freshbooks | Simple invoicing, time tracking, expense management, client portal. | Plans start at $2/month | Great if you bill clients, track time, and want super simple invoicing. |

| Puzzle | Real-time financial dashboard, automated bookkeeping, investor-ready reports. | Free plan for businesses available; Paid plans start at $50/month | Built for founders who need real-time financial dashboards, runway insights, and investor-ready reports. |

| Patriot | Payroll integration, simple interface, strong compliance tools | Plans start at $10/month | Affordable and straightforward with payroll integration for small teams. |

| Sage | Comes with multi-currency support and inventory management, making it strong for international growth. | Plans start at $17/month | Startups planning to scale globally and need advanced accounting |

| Precoro | Purchase order management, spend control, approval workflows | Plans start at $499/month | Not a full accounting tool, but perfect for startups that need strong spend control and approval workflows. |

Best Accounting Software for Startups

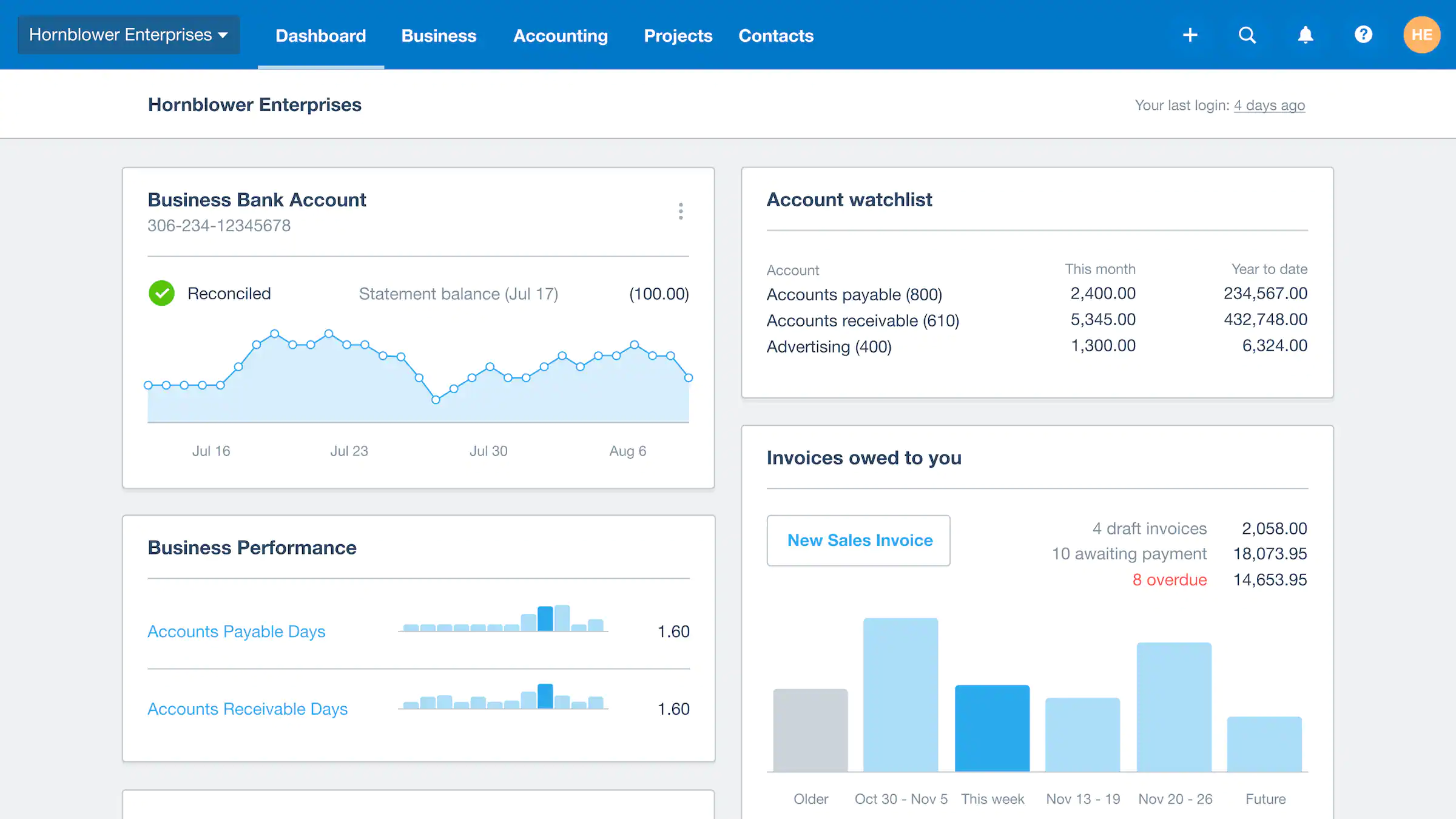

1. Xero – Best for Scaling Startups

If your startup is growing fast and you need a tool that scales with you, Xero is a great pick. One of its best features is unlimited users. Many accounting tools charge more the minute you add extra team members, but Xero lets everyone, your co-founder, bookkeeper, or accountant, jump in without extra cost.

It’s also big on integrations. With over 1,000 third-party apps, you can link Xero to your payroll system, project management tool, or even your favorite e-commerce platform.

This makes it easier to manage your entire business in one place. And for startups that need clarity, Xero’s financial dashboards and reporting are spot-on. You can track cash flow in real time and see whether you are on track to hit your goals, instead of guessing.

Xero is built for startups that don’t want to outgrow their accounting software. With unlimited users, deep integrations, and powerful reporting, you will have the visibility and flexibility to manage growth confidently. Choose Xero if you want to future-proof your finances.

| Pros of Xero | Cons of Xero |

|---|---|

| Unlimited users with no extra fees | Learning curve for new users |

| Automated bank feeds save time by pulling in transactions daily. | Higher cost compared to some free landlord accounting software . |

| Cloud-based access from anywhere | Invoicing less customizable than some competitors |

2. Zoho- Free Accounting Software for Startups

If you are a startup founder juggling multiple hats, Zoho Books can feel like a lifesaver. One of its biggest strengths is automated invoicing. Instead of creating invoices manually or worrying about late payments, Zoho lets you set up recurring invoices, send reminders automatically, and even accept online payments.

That means less chasing clients and more steady cash flow.

Another standout feature is its expense tracking. For many startups, small costs slip through the cracks, subscriptions, software tools, travel, and supplies. With Zoho, you can snap pictures of receipts, categorize expenses, and see exactly where your money is going. This makes staying on top of budgets much easier and helps prevent overspending.

And because startups often use multiple tools, Zoho shines with its integrations. It connects seamlessly with other Zoho apps like CRM and Inventory, as well as third-party apps like PayPal, Stripe, and G Suite. This means your accounting doesn’t live in a silo; it’s part of your whole business workflow. Don’t wait until things get messy; start clean and stay organized.

| Zoho Pros | Zoho Cons |

|---|---|

| Free plan for small startups (under $50k revenue) | Free plan has strict limits |

| Easy expense tracking with receipt uploads | Some advanced features only in higher tiers |

| Good tax compliance features | Can get expensive as you upgrade plans |

3. FreshBooks – Best for Service-Based Startups

If you are running a service-based startup or freelancing, FreshBooks is your friend. Its standout feature is client billing and invoicing. You can send professional invoices in seconds, track when clients open them, and even accept credit card payments right through the invoice.

It also comes with time tracking, which is perfect if you bill by the hour or need to know how much time projects are taking. That way, you are not leaving money on the table.

Additionally, FreshBooks has a super user-friendly interface. You don’t have to be an accountant to figure it out, which is a huge relief for founders who just want to get the basics right without a steep learning curve.

If your startup relies on client work such as consulting, freelancing, design, or services, FreshBooks is designed for you. Stop wasting time chasing payments and focus on delivering great work.

| Pros | Cons |

|---|---|

| Super simple invoicing for clients | Not ideal for large teams |

| Mobile-friendly and easy to use | Reporting features are basic |

| Strong customer support | Pricing increases quickly with team size |

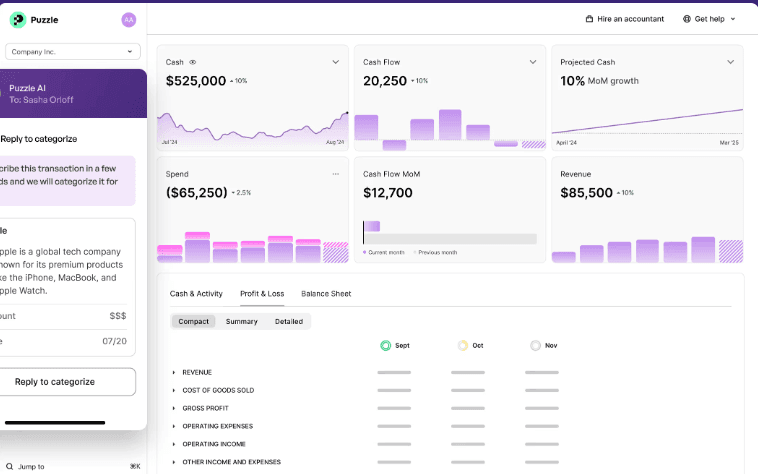

4. Puzzle – Best for Investor-Ready Startups

For early-stage startups, Puzzle is like having a finance team in your pocket. One of Its main features is real-time dashboards that gives you a live view of your startup’s financial health. Instead of waiting for month-end reports, you can see your runway, burn rate, and cash flow instantly.

Puzzle also automates bookkeeping, so you don’t have to waste time on data entry. This is a huge time-saver when every hour matters. And if you are gearing up for fundraising, Puzzle makes you look good. It creates investor-ready reports that help you tell your financial story clearly and confidently.

| Pros | Cons |

|---|---|

| Real-time financial dashboards | Relatively new tool with limited history |

| Automated bookkeeping (no manual entry) | Custom pricing |

| Built specifically for startups | Fewer integrations |

5. Patriot – Best for U.S. Startups with Payroll Needs

Patriot is all about keeping accounting and payroll simple without breaking the bank. Its built-in payroll integration is a major perk, no more juggling separate systems for paying your team and managing expenses.

The tool itself is extremely easy to navigate, so you don’t need advanced accounting knowledge to get started. Plus, it handles compliance basics really well, helping you stay on top of tax forms and payroll regulations.

For budget-conscious startups, Patriot hits that sweet spot between affordability and reliability. For U.S.-based startups with small teams, Patriot takes the stress out of both accounting and payroll. It’s affordable, easy to use, and keeps you compliant with taxes. If you are hiring and paying employees, this is the no-brainer choice.

| Pros | Cons |

|---|---|

| Simple, beginner-friendly design | Limited advanced features |

| Easy payroll integration | No built-in time tracking |

| Strong value for small teams | Reporting isn’t very detailed |

6. Sage – Best for Global Startups

Sage is a solid choice if you are thinking long-term. Its multi-currency support is a game-changer for startups that plan to operate globally or deal with international clients. It also offers inventory tracking, which is a must if your startup sells physical products. Instead of managing stock manually, Sage keeps everything up to date in real-time.

The platform is robust, making it better suited for startups that plan to grow into more complex accounting needs down the line. If you are ready to scale globally. Don’t wait until you are “big enough”, build on a tool that grows with you from day one.

| Pros | Cons |

|---|---|

| Multi-currency support | Some features locked behind higher tiers |

| Scales well for growing businesses | Interface less modern than others |

| Inventory tracking built-in | Can feel too complex for very small startups |

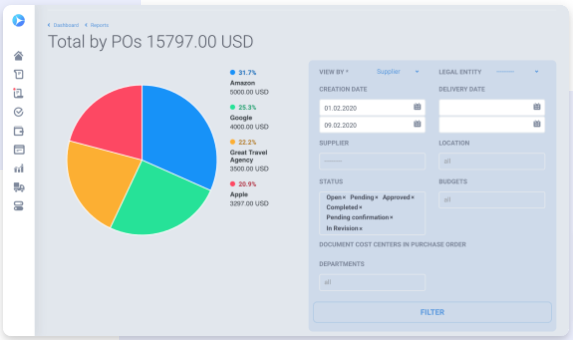

7. Precoro – Best for Procurement & Spend Control

While not a full accounting suite, Precoro is a fantastic tool for managing procurement and expenses. Startups often struggle with spending control; team members make purchases, but no one is tracking approvals or budgets.

Precoro fixes that by offering purchase order management and approval workflows, so you know exactly where money is going before it is spent.

It is especially useful for startups that have multiple team members handling purchases, since it prevents overspending and keeps budgets in check. Startups often lose track of purchases as teams grow. Use Precoro to keep budgets tight and avoid unnecessary burn.

| Pros | Cons |

|---|---|

| Strong procurement & expense control | Pricing starts higher than some tools |

| Approval workflows keep spending in check | Limited integrations |

| Good for growing teams with multiple buyers | Not a full accounting suite |

How to Choose the Right Accounting Software for Your Startup

Here is a quick decision-making framework:

| Pre-revenue / bootstrapping: | Start with Zoho Books (Free) or FreshBooks Lite. |

| Scaling fast with a small team: | Choose Xero or Puzzle. |

| Hiring employees in the U.S.: | Go with Patriot for payroll compliance. |

| Selling globally or managing inventory: | Sage is the strongest choice. |

| Need to control spending across teams: | Precoro is worth the investment. |

Final Thoughts on Best Accounting Software for Startups

Managing rental property finances does not have to mean endless spreadsheets, missed receipts, and stressful tax prep. The right accounting software can simplify rent collection, automate bookkeeping, and give landlords more time to focus on growing their portfolio.

From powerful all-in-one platforms like Xero and Zoho Books to landlord-specific tools like Landlord Studio, Stessa, and REI Hub, there is a solution for every type of property owner. If you want automation and AI-driven insights, Puzzle and Precoro bring advanced features to streamline operations.

For budget-friendly options, Patriot and FreshBooks offer simple yet effective tools, while Sage provides scalability for landlords with growing property portfolios.

If you are just starting out, you can test the waters with best free property management software for small landlords like Stessa or Landlord Studio’s free plan. At the end of the day, the best accounting software for landlords depends on your goals, budget, and property size.

Whether you need free landlord accounting software, rental property accounting software for small landlords, or a fully integrated system, the tools above are tested, trusted, and designed to make rental accounting easier.

The best accounting app for a small business depends on your needs and budget. If you are looking for something free, Zoho Books offers a great starter plan for businesses earning under $50k/year. For service-based businesses like freelancers or agencies, FreshBooks is perfect for client invoicing and time tracking. If you are scaling quickly and need more advanced features, Xero is a strong choice with unlimited users and powerful reporting.

Xero is definitely one of the best cloud accounting software for startups and small businesses, especially if you are planning to grow fast. Its biggest advantage is unlimited users at no extra cost, making it ideal if you have co-founders, accountants, or a finance team. With over 1,000 integrations and strong reporting tools, it is perfect for scaling startups. However, for very early-stage businesses, simpler and cheaper options like Zoho or FreshBooks might be a better fit.

Most professional accountants rely on popular platforms like QuickBooks, Xero, and Sage. These are widely accepted in the accounting industry because they offer robust reporting, compliance features, and integrations with tax and payroll tools. For startups, this is good news because it means your accountant will likely already be familiar with whichever tool you choose. If you want maximum compatibility with accountants and bookkeepers, Xero or QuickBooks are the safest bets.