Are you interested in expanding your business in Latin America but concerned about the compliance and payment issues? If that is the case, we suggest using an employer of record (EOR) service in Latin America. This will help you manage your employment responsibilities.

An Employer of Record (EOR) helps Latin American companies reduce legal issues and penalties. An EOR does this by making it easier to enter the market and ensuring compliance with local laws. The EOR is responsible for payroll, taxes, and employee benefits and maintains compliance with complex labor and tax legislation.

Furthermore, EOR services allow businesses to access talent throughout Latin America without incurring significant administrative costs. This article will discuss the best employer of record in Latin America.

What is the meaning of EOR in Latin America?

An Employer of Record (EOR) in Latin America is a third-party entity that manages employment matters for your business. It covers payroll, taxes, benefits, and adherence to regional labor regulations.

Companies can save time and money by hiring workers in another nation without creating a legal corporation. An Employer of Record (EOR) is a solution that encourages compliance, lowers risks, and speeds up the employment process.

Benefits of Using Employer of Record in Latin America

- Streamlining Labor Law Compliance Across Borders

An EOR solution helps your company follow local rules. This reduces the risk of fines or legal problems. Compliance is one of the most challenging parts of hiring people from other countries in Latin America. An EOR does the magic, especially in regions where each country has its employment contract and termination regulations.

- Cost-Effective Talent Acquisition in Emerging Markets

Using an employer of record is a good strategy. It helps small and medium-sized businesses grow in Latin America. This approach helps them access skilled workers at a lower cost.

An EOR helps businesses find top talent in emerging markets. This is cheaper than setting up a local entity. Creating a local entity means paying registration fees, renting office space, and handling ongoing costs.

- Simplified Payroll and Tax Management

A Latin America EOR handles payroll in different currencies and local tax systems. They make sure payments are accurate and on time while meeting local tax rules.

Payroll involves calculating salaries, deducting taxes, and contributing to social security systems, which vary by country. An EOR’s expertise ensures accuracy and security, saving your business from errors or delays.

- Enhanced Employee Experience

One key benefit of using an employer of record is that it boosts employee satisfaction. It keeps employees by offering good benefits and support. Employees value clear communication, timely payments, and attractive benefits packages, which an EOR can help deliver.

- Access to Global Mobility Solutions

An EOR facilitates employee relocation and remote work arrangements and guarantees adherence to work permits and immigration regulations.

EORs facilitate smooth international mobility by streamlining visa applications and guaranteeing legal compliance.

- Workforce Management Flexibility

EOR services help organizations adjust their staff based on project needs. This allows them to avoid the long-term commitments of traditional hiring.

7 Best Employer of Record in Latin America

- Velocity Global – Overall best

- Deel – Best in global hiring

- Remote – Best in global talent management

- Remofirst – Best in managing remote workers

- Oyster – Best in compliance management

- Multiplier – Best in tax regulation

- Rippling – Best in scalability

1. Velocity Global: Overall Best

Velocity Global is the largest global employer of records beyond national boundaries. It is the top employer of record (EOR) service. Businesses in more than 185 countries around the world trust it to manage their workforce well.

With a strong presence across Latin America, Velocity Global specializes in helping companies expand into the region seamlessly and compliantly. Their comprehensive services include hiring, payroll, compliance management, and employee support, all tailored to each country’s unique needs.

Velocity Global ensures businesses can focus on growth while they handle the complexities of international employment. Their commitment to compliance, flexibility, and employee satisfaction has made them a preferred partner for organizations looking to enter or scale in Latin America.

Benefits of Using Velocity Global EOR

- Hiring Abroad

Velocity Global makes it easier for companies to hire workers in Latin America without setting up a local office. To ensure adherence to regional labor regulations, they manage employment contracts, onboarding, and all other legal obligations.

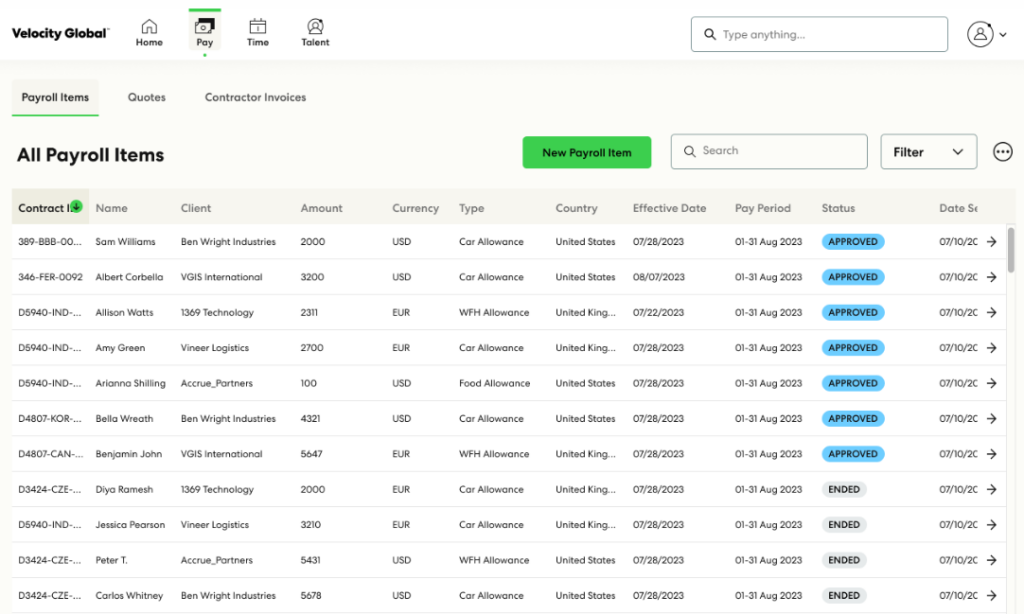

- Management of Payroll

This solution oversees payroll processes and guarantees that workers receive their paychecks on schedule and accurately. Velocity Global manages payments in many currencies and ensures that social security contributions and local tax laws are followed.

- Administration of Benefits

Velocity Global provides competitive and compliant benefit packages, depending on each nation’s needs. These ensure employee happiness and cover healthcare, retirement schemes, and statutory leave.

- Assistance with Taxes and Compliance

By ensuring that all employment procedures adhere to local legislation, the EOR helps firms reduce their legal and financial risks. They also handle audits, tax filings, and other compliance issues.

- HR Services and Employee Support

By providing ongoing support, Velocity Global addresses the requirements and worries of its staff. Its HR services include conflict mediation, performance management, and staff training.

- Solutions for Global Mobility

This EOR manages work permits, visa applications, and immigration compliance for companies that must move staff or oversee remote teams, guaranteeing a smooth transition.

- Tailored Approaches to Business Requirements

Velocity Global provides customized solutions that meet any company’s objectives, whether those objectives are market testing, temporary project management, or operational scalability.

Pros and Cons

Pros

- Customer support

- Global service

- Comprehensive service

Cons

- Benefit administration

- Limited personalization

- Variable expertise

2. Deel- Best in Global Hiring

Deel is an Employer of Record (EOR) supplier that helps firms hire, manage, and compensate employees worldwide. Its technology-focused platform simplifies the complex process of working overseas. Deel is distributed in over 150 countries.

Continuously monitoring and emphasizing the most recent payroll regulation developments ensures continuing compliance and secure payments. With Deel Payroll software, your company can attest to employee benefits and deductions, local filing with authorities, salary and tax payments, create and distribute paystubs, local contracts, and documents, and ensure compliant onboarding and offboarding.

Deel integrates with your choice of HR software to reduce human labor while accurately processing payrolls across all team time zones.

Benefits of Using Deel EOR

- A platform for International Hiring

Thanks to Deel, businesses can engage independent freelancers or full-time staff in more than 150 countries. Their technology streamlines and expedites international employment by automating contract creation, onboarding, and compliance checks.

Payroll Automation

Deel’s payroll system guarantees timely, precise payments in various currencies. Additionally, the platform oversees tax contributions and deductions, guaranteeing adherence to regional regulations.

- Management of Compliance

Businesses can use Deel to comply with local labor laws, including those pertaining to tax returns, social contributions, and contract obligations. The website offers country-specific legal document templates.

- Administration of Comprehensive Benefits

To guarantee competitive employee offerings, Deel assists companies in providing localized benefits such as health insurance, pension schemes, and paid time off.

- Accessible Technology

Deel’s user-friendly platform offers organizations real-time information and optimized workflows by integrating easily with current accounting and HR systems.

Pros and Cons

Pros

- Extensive global coverage

- Flexible payment option

- User-friendly interface

- Constant support

- Fast onboarding

Cons

- Learning curve

- No native payroll

- Limited document localization

- Third-party services

3. Remote EOR- Best in Global Talent Management

Remote is a global human resources platform for companies looking to grow globally. It helps firms grow globally by employing and leading teams and guaranteeing on-time payments. Remote EOR takes care to abide by regional labor regulations.

It provides excellent services for managing taxes, paying personnel, offering benefits, and adhering to local regulations when employing people worldwide.

Its strong API capabilities are the reason for this. These features aid in streamlining and increasing the efficiency of procedures. By ensuring that your employment procedures adhere to regional laws and norms, using remote can help your firm expand.

Benefits of Using Remote EOR

- Comprehensive HR and Legal Compliance

Remote provides comprehensive HR and legal compliance assistance, surpassing simple payroll and taxation. It negotiates intricate international labor laws to guarantee that companies follow regional rules.

- Protection of Intellectual Property and Data

It offers strong protection for both, which is uncommon among EOR services. Businesses that handle sensitive data internationally must do this.

- Management of localized benefits

Remote distinguishes itself by managing and offering localized benefits across many nations. This feature customizes benefits packages to each nation’s unique standards, increasing employee satisfaction.

Remote Employee Onboarding

Remote EOR manages the onboarding process for remote employees, including preparing compliant contracts, facilitating orientation, and handling necessary documentation.

Pros and Cons

Pros

- User-friendly platform

- Global coverage

- Compliance Assurance

Cons

- Limited customization

- Lacks live training

4. RemoFirst EOR- Best in Managing Remote Workers

Remofirst is a worldwide Employer of Record (EOR) platform that handles companies’ employment needs. It primarily acts as a legal middleman, allowing businesses to grow internationally, reach a larger pool of people, and optimize operations while maintaining complete compliance with national labor laws and regulations.

Benefits of Using RemoFirst EOR

- Dedicated Account Manager:

In contrast to many payroll services, Remofirst provides each customer with a dedicated account manager. By providing a consistent point of contact for all payroll-related concerns, this human touch greatly improves user experience and problem-solving effectiveness.

- International Hiring Capabilities:

Remofirst is very good at hiring people from other countries. Its software is built to manage the intricacies of international payroll, including different tax regulations and compliance concerns.

- Real-Time Compliance Updates:

Remofirst provides real-time compliance updates, which is an essential function for companies with international operations. Its ability to guarantee that payroll processing always complies with the most recent regulatory standards distinguishes it from many other platforms that can need manual updates.

- Employee Onboarding and Offboarding:

Remofirst manages every facet of employee onboarding and offboarding to guarantee a smooth experience for the company and the worker. By simplifying these procedures, Remofirst assists businesses in upholding professionalism and compliance even during changes.

- Integrations

Remofirst provides various connectors to improve its employer of record (EOR) services and streamline operations for remote teams. Thanks to these integrated connections, Remofirst is easily connected to well-known accounting programs, HR systems, and time-tracking devices. These connections let customers automate different payroll and HR procedures and preserve data consistency. For example, integrating with HR systems reduces the need for manual entry by facilitating simple data synchronization and transfer.

Pros and Cons

Pros

- Responsive customer support

- Real-time reporting

- Global reach

- System Integration

Cons

- Limited customization

- Long learning curve

5. Oyster - Best in Compliance Management

Oyster is your partner for all your global talent needs, not just an employer of record. It provides you with national coverage, local information, and great employee experiences on one platform. No hidden fees exist.

Oyster EOR enables recruiting anywhere in the world with dependable, compliant payroll and excellent local benefits and bonuses. Global employment entails more than just employing and paying around the world.

It streamlines your HR operations and provides an unparalleled employee experience from starting to finishing.

Oyster’s simple EOR service enables you to form a global workforce. Its tools make it easier to pay employees, provide benefits, and handle taxes. It also provides information on local job marketplaces.

Benefits of Using Oyster EOR

- Compliance Management:

Oyster is excellent at ensuring that local labor rules and regulations are followed in various jurisdictions. Their technology reduces legal risks for businesses by automatically handling social contributions, tax withholdings, and other legislative requirements.

- User-Friendly Platform:

Oyster’s cutting-edge, user-friendly interface makes managing multinational teams easier. By streamlining procedures like payroll, document management, and onboarding, the platform helps companies better oversee their global staff.

- Global Hiring Cost Calculator

The Oyster platform has a recruiting cost calculator. This tool shows the cost of hiring workers in different countries. It factors in

Salary ranges for this position: taxes, social contributions, and employer responsibilities.

- Expense and Time Tracking

Oyster offers tools to assist businesses in managing employee spending and tracking work hours. These tools include the following:

Streamlined the expenditure submission and approval processes.

- Manage reimbursements by local tax legislation.

- Time-tracking capabilities help managers manage staff who work in multiple time zones.

- Making it easy to manage distant teams while adhering to local laws.

Pros and cons

Pros

- Onboarding

- Benefits management

- Payroll processing

Cons

- Limited nations

- No peo option

- Separate platform

6. Multiplier - Best in Tax Regulation

Multiplier is a global Employer of Record (EOR) platform that streamlines international hiring, payroll, and compliance for organizations expanding globally. The platform lets businesses hire and manage full-time employees and contractors in more than 150 countries. They can do this without creating local legal entities.

Multiplier serves as the legal employer for businesses. It ensures compliance with local labor laws and tax rules. It also meets statutory requirements. Additionally, it offers a simple platform for managing a global workforce.

Benefits of Using Multiplier

- Localized Payroll Management:

Another distinguishing feature is the localized payroll management. It automates payroll tasks and adjusts to local tax and employment laws. This is not common in regular HR software.

- Contractor Management:

Multiplier has special features for managing overseas contractors. This includes creating contracts based on local laws and efficient payment processes. This focus on contractor management sets it apart from other HR products.

- Global Employment Compliance:

Multiplier’s most distinguishing feature is its comprehensive compliance management for multinational employment. Unlike many other HR software, it delivers deep insights into local labor rules across many nations, considerably lowering legal risks for organizations growing internationally.

- Both onboarding and offboarding

The technology ensures that new personnel are swiftly assimilated into the team by streamlining the onboarding process. Multiplier guarantees appropriate documentation and adherence to regional termination regulations for offboarding.

Pros and cons

Pros

- Global compliance

- User-friendly interface

- Payroll automation

Cons

- Limited customization

- Higher cost for small business

- Limited integration

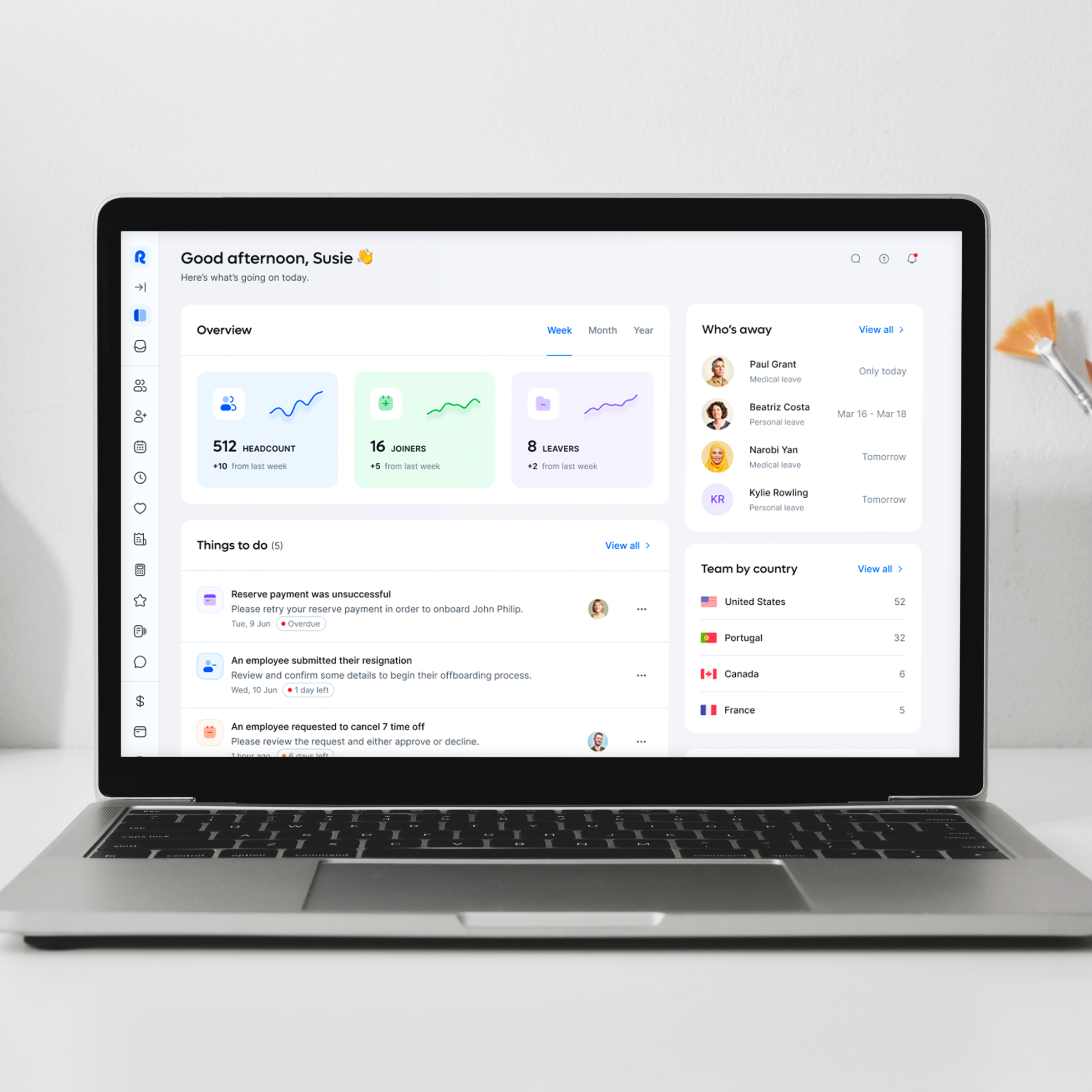

7. Rippling - Best in Scalability

Rippling is an all-in-one platform that streamlines the complete employee lifecycle, from hiring to benefits administration, and includes HR, IT, payroll, and spend management features. In addition to automating HR duties, Rippling guarantees compliance and streamlines approvals.

Rippling may also use the same interface that supports payroll, real-time financial insight, and dynamic expenditure policies to manage devices, software access, and compliance monitoring. A complete HR and worldwide payroll solution, Rippling makes hiring, compensating, and managing staff easier. It provides cloud-based services that help companies better manage their workforces.

Benefits of Using Rippling

- Global Hiring and Onboarding: Rippling makes it easier to hire and onboard workers worldwide, handling everything from legally valid employment contracts to enrolling in benefits and completing mandatory training.

- Payroll Processing: The platform manages computations and money transfers to pay workers in their native currencies promptly, guaranteeing accurate and quick payroll processing for your worldwide workforce.

- Management of Compliance: Rippling closely monitors and enforces adherence to regional labor laws and regulations, including in-product safeguards and knowledgeable local counsel, to reduce legal and reputational risks.

- Benefits Administration: The program provides regionally tailored benefit plans to attract and retain personnel, and payroll-synchronized deductions facilitate administration.

Pros and Cons

Pros:

- Comprehensive platform integration

- Global hiring capability

- Automated compliance

- Efficient payroll management

- Scalability

- Customizable workflows

- Integration-friendly

- Time-saving automation

- User-friendly interface

Cons:

- Pricing transparency

- Limited global reach compared to competitors

- Learning curve

- Add-on costs

- Internet dependence

- Regional support variability

How to choose an EOR in Latin America

- Understand Your Business Needs: The first step in choosing an EOR in Latin America is ascertaining your unique business requirements. Determine the range of services you need first, such as payroll processing, tax compliance, human resources tasks, or employee benefits administration.

Since labor laws and regulations vary significantly around the region, selecting an EOR who specializes in the markets you are trying to reach is crucial.

Further, consider if you have any industry-specific requirements, such as handling particular job types or sector-specific laws. Finding these elements will guarantee that you choose an EOR who can offer the appropriate degree of assistance for your

- Geographical region: When selecting an EOR, it’s important to consider geographical coverage. In Latin America, for instance, this means knowing the labor laws and tax regulations in key countries like Mexico, Brazil, Argentina, and Colombia.

- Tax processing and payroll: When choosing an Employer of Record (EOR), the employee oversees various functions on behalf of businesses, including payroll distribution, tax withholding, and filing with local authorities.

They monitor compliance with local labor laws, stay current on regulatory developments, and keep correct records for transparency for auditing purposes. Outsourcing these functions to an EOR allows firms to reduce administrative burdens, minimize regulatory issues, and focus on core operations.

- How Much Support Can You Expect From The EOR?

The degree of assistance that an EOR offers can determine whether your global employment plan succeeds or fails. Fast response times and practical help are crucial, particularly when handling complicated matters like payroll inquiries or legal compliance in countries you may not be familiar with.

Make sure the EOR provides your staff with committed assistance. Asking whether specialized assistance is free is important because some EOR providers charge more.

- What Is the Pricing Process at The EOR?

Finding an EOR with open and honest pricing is crucial. Unexpected cost increases may result from some providers’ hidden fees, such as onboarding and offboarding fees. Choose an EOR that is cost-effective, explains what is included in their pricing, is straightforward in their billing, and fully communicates all potential charges upfront.

- Check clients reviews

Reviews provide real-world insights into the provider’s performance, reliability, and customer service, helping you gauge their suitability for your business needs.

Start by looking for testimonials or case studies on the EOR’s website. These often highlight success stories and specific examples of how the provider has supported businesses like yours.

Furthermore, remember they may only show the most positive experiences.

By carefully analyzing client reviews, you can understand what to expect and choose an EOR that aligns with your business needs and expectations.

Factors that can Influence the Pricing of Employer of Record in Latin America

The cost and pricing of Employer of Record (EOR) services in Latin America involve several factors.

- Service fees: Service fees are a primary component and are often charged as a flat monthly fee per employee, ranging from $200 to $1,000, or as a percentage of the employee’s salary, typically between 10% and 15%.

- Country-specific costs: This significantly influence pricing since labor laws, tax requirements, and mandatory benefits vary across Latin America. Countries with more complex regulations, such as Brazil and Argentina, often have higher costs, while countries with more straightforward requirements, like Peru or Colombia, tend to be more affordable.

- Payroll and Compliance: Payroll and compliance management fees are generally included in the service fee but can vary based on the level of complexity in meeting local regulations. These services ensure payroll is processed accurately and taxes and benefits are handled in full compliance with local laws.

- Onboarding and setup costs: These are usually one-time fees and can range from $500 to $5,000, depending on the number of employees and the intricacy of onboarding processes in a particular country.

Additional services, such as recruitment, termination support, or consulting, might incur extra charges. These costs are often determined on a case-by-case basis, depending on the business’s specific needs.

Final Thoughts

Businesses hoping to enter the dynamic Latin American market must choose the region’s best Employer of Record (EOR). We recommend Velocity Global as the best employer of record service in Latin America. It offers experienced HR support, smooth compliance, and effective payroll management tailored to regional markets.

By collaborating with a reliable EOR supplier, companies can concentrate on expansion, take advantage of Latin America’s highly qualified labor pool, and confidently negotiate the region’s complex regulatory environment. This collaboration guarantees seamless economic growth, making it a calculated step for any company hoping to succeed in Latin America.