Did you know that small to medium-sized enterprises (SMEs) are shifting to cloud-based accounting solutions to streamline their financial management and improve efficiency? Yeah, they are.

With automation becoming the new norm in bookkeeping, more entrepreneurs are turning to digital solutions that save time and cut down on costly errors. That’s exactly why I decided to take a closer look at Zoho Accounting Software, a tool that’s been gaining attention in SMEs and startup space.

I first came across Zoho when I was helping a client streamline their invoicing process. They were juggling spreadsheets, late payment reminders, and manual expense tracking, and it was clear they needed something more reliable. Zoho Books immediately stood out because it was not just an accounting tool; it felt like a full financial management solution tailored for modern businesses.

That’s what sparked my interest to dive deeper into its features and share this review with you.

What Is Zoho Accounting Software?

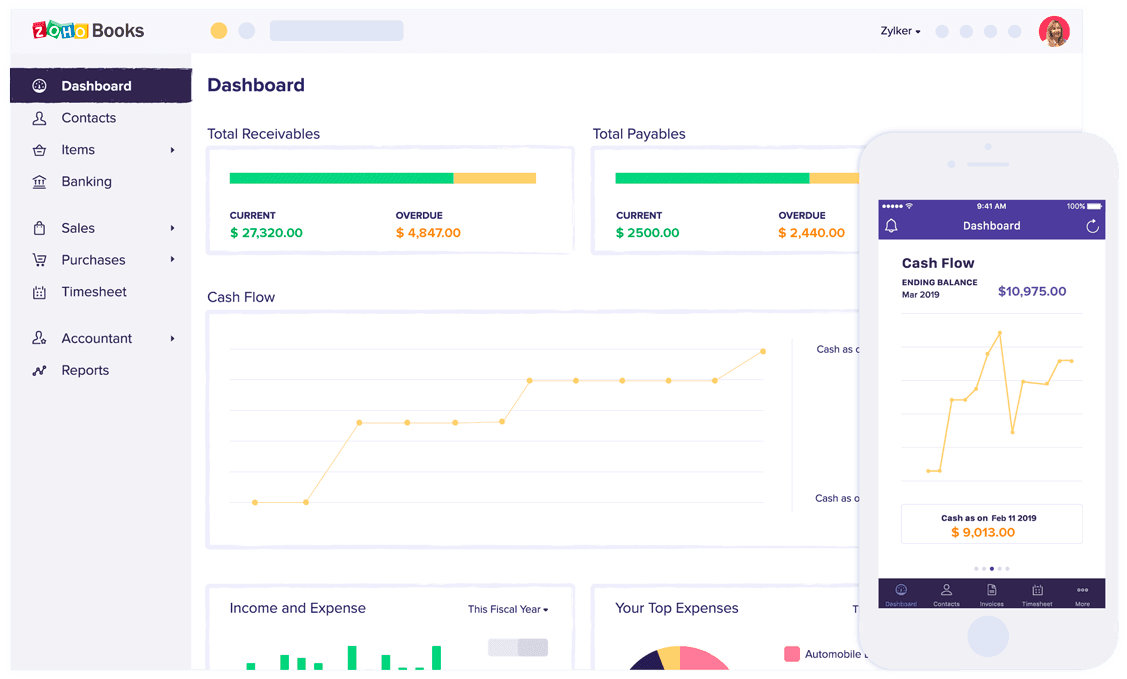

Zoho Accounting Software, also known as Zoho Books, is a cloud-based platform designed to help businesses manage their finances with ease. At its core, it handles the essentials like invoicing, expense tracking, tax management, and financial reporting, but it goes beyond the basics by offering smart automation features.

What makes Zoho stand out is its ability to integrate seamlessly with other Zoho apps and third-party tools, creating an all-in-one ecosystem for business management. Unlike many accounting tools that feel bulky or overly complex, Zoho is simple, intuitive, and scalable, making it a great fit for SMEs, startups, freelancers, and growing businesses alike.

Who Is Zoho Accounting Software for (and Not for)?

Zoho Accounting Software is best suited for small businesses, freelancers, startups, and growing companies that need a straightforward yet powerful way to manage their finances. If you are someone who struggles with manual bookkeeping, late invoices, or disorganized expense tracking, Zoho can be a game-changer. Its clean interface, automation features, and ability to scale make it especially attractive for entrepreneurs who don’t have a dedicated accountant but still want professional-level financial management.

On the other hand, Zoho may not be the best fit for large enterprises with highly complex accounting needs or companies that require deep industry-specific features, such as advanced manufacturing or nonprofit fund accounting. While Zoho is flexible and capable, businesses with highly specialized accounting structures might find themselves needing more advanced, niche solutions.

My Favorite Features About Zoho Accounting Software

After diving into Zoho Accounting Software, several features really impressed me. What I like most is that these are not just flashy add-ons; they actually solve common headaches that small business owners, freelancers, and startups face daily. Here are the standout features that make Zoho worth considering:

- Smart Invoicing

Creating and sending invoices can be time-consuming, especially when you are managing multiple clients. Zoho makes it incredibly simple to design professional invoices, add your logo, and even set them up in different currencies. The best part is you can automate payment reminders so clients get a nudge when their bills are due, no awkward follow-up emails needed.

- Expense Tracking on the Go

If you have ever lost a receipt or struggled to remember where that business lunch expense came from, this feature is a lifesaver. With Zoho’s mobile app, you just snap a picture of your receipt, and it automatically records the expense. It’s perfect for entrepreneurs who are always on the move, like consultants or sales reps. No more end-of-month panic trying to piece expenses together.

- Automated Workflows

This is where Zoho really shines. You can set up custom rules so repetitive tasks take care of themselves. For instance, recurring invoices for subscription-based businesses are automatically sent out, and transactions can be auto-categorized based on past behavior. Imagine running a co-working space; you do not need to manually bill members every month; Zoho handles it while you focus on growing the business.

- Tax Compliance Made Simple

Tax season can be overwhelming, especially for small businesses without a dedicated accountant. Zoho Books automatically calculates VAT, GST, or sales tax based on your region and applies it correctly on invoices. For a startup owner in the UK or a freelancer in Canada, this means no more second-guessing tax rules; everything is neatly organized and ready when it’s time to file.

- Seamless Integrations

Zoho is part of a larger business ecosystem, which means it connects smoothly with Zoho CRM, Zoho Inventory, and even third-party apps like PayPal, Stripe, and G Suite. This is a game-changer for businesses that want their sales, customer data, and accounting to flow together without jumping between multiple platforms. For example, a small online store can sync sales orders from Zoho Inventory directly into Zoho Books, keeping everything updated in real time.

Together, these features make Zoho feel less like an “accounting tool” and more like a business partner that streamlines daily operations, saves time, and reduces financial stress.

Downsides of Zoho Accounting Software

As much as I like Zoho Accounting Software, there are concerns. Like any tool, it has a few limitations that may make it less appealing depending on your business needs. Here are some of the main downsides we have noticed:

- Limited Payroll Features

Zoho does not have a built-in payroll system in most regions, which can be frustrating for businesses with employees. You will need to use a third-party tool or manual workarounds for salaries, benefits, and tax deductions.

- Steeper Learning Curve for Beginners

While the interface is clean, some features like advanced reporting or automation workflows can feel overwhelming if you are new to accounting software. A complete beginner may need a bit of time (or guidance) to fully unlock its potential.

- Feature Restrictions on Lower Plans

Zoho’s entry-level plans are affordable, but they come with limits on the number of invoices, users, or projects you can manage. This means growing businesses might outgrow the lower-tier plan faster than expected.

- Customer Support Could Be Better

Zoho offers support, but many users have noted that response times can be slow, especially for technical issues. This can be a real pain if you rely heavily on the software for day-to-day operations.

- Not Ideal for Large Enterprises

Zoho shines in the small-to-medium business space, but larger companies with complex accounting requirements (like multi-entity consolidations or advanced financial forecasting) may find it lacking compared to heavyweight tools.

Zoho is fantastic for freelancers, startups, and growing businesses, but it’s not without its rough edges. Knowing these limitations upfront helps you decide if it’s truly the right match for your business.

How to Use Zoho Accounting Software

- Sign Up and Set Up Your Organization

- Create a Zoho account (or log in if you already use other Zoho apps).

- Enter your Organization details like name, industry, location, and Address.

- Tip: If you operate in multiple countries, set the default tax rules early; it will save you headaches later.

- Customize Your Dashboard

- Once inside, you will see your dashboard with key financial stats (income, expenses, cash flow).

- You can rearrange widgets so the most important metrics, like unpaid invoices or monthly expenses, show up first.

- Add Customers, Vendors, and Items

- Input customer and vendor details so invoicing and expense tracking become seamless.

- If you sell products, add them to your inventory. If you are a service provider, you can create service categories instead.

- Create Your First Invoice

- Head to the “Sales” tab, click + New Invoice, and fill in customer details, payment terms, and line items.

- Customize the invoice with your logo and colors for a professional look.

- Pro Tip: Set up recurring invoices if you bill clients regularly.

- Track Expenses and Receipts

- Go to the “Expenses” tab and record purchases.

- Use the mobile app to snap a picture of receipts and upload them instantly, Zoho automatically extracts details like amount, vendor, and date.

- Automate Workflows

- Under “Settings,” you can create rules like auto-sending payment reminders or categorizing transactions.

- Example: Automatically email customers a thank-you note once payment is received.

- Generate Reports

- Zoho offers over 50 reports, including profit & loss, balance sheet, and tax summaries.

- You can schedule these to be emailed to you weekly or monthly, keeping you updated without logging in every day.

Zoho Accounting Software Pricing

One of the appealing things about Zoho (Zoho Books in particular) is that it offers a range of pricing tiers to match different business sizes and needs. That said, like any software, there are trade-offs, and local pricing or add-ons can affect your final cost. Here’s a breakdown:

Prices above are for annual billing. Monthly billing is also typically available, but at a slightly higher rate.

- Zoho usually offers a 14-day free trial so you can test paid features.

- Add-on costs may arise (e.g., extra user licenses beyond the plan’s limit).

- There are transaction or volume limits (e.g., number of bills/expenses allowed per year per plan).

Hidden Costs & Things to Watch Out For

- Extra users beyond plan limits: If your team grows, you may need to pay for additional user seats.

- Add-ons / modules: Some features (like advanced scanning, extra locations, or expense claims modules) might cost extra.

- Transaction limits: Some plans cap how many invoices, bills, or expense entries you can make annually. If you exceed, you may need to upgrade or pay for overage.

- Currency / tax add-ons: If you need multi-currency support, advanced tax features, or use multiple company setups, these can push you into higher tiers.

- Support / priority support: The level of customer support (faster response, onboarding assistance) is often tied to higher plan tiers.

If you are just starting, Zoho’s Free plan is generous enough to handle basic needs without cost. As your business scales, you can move into Standard or Professional tiers and pick up more advanced features. But depending on your usage, team size, number of transactions, and integration needs, you may find yourself needing a higher plan sooner than expected.

Final Thoughts on Zoho Accounting Software Review

Zoho Books is a well-rounded accounting software that strikes a balance between affordability, usability, and powerful features. Its biggest strengths lie in its clean interface, automation tools, seamless integrations, and strong support for small to medium-sized businesses that want to manage their finances without drowning in complexity. On the flip side, some of its limitations, such as limited features in the free plan and an occasional learning curve with advanced settings, can be frustrating for users with more complex or evolving needs.

For freelancers, startups, and small businesses on a budget, Zoho Books’ free plan is a fantastic entry point, giving you the essentials without financial strain. If you are running a growing company that needs multi-user access, inventory tracking, or advanced reporting, the paid tiers still offer excellent value compared to many competitors. And for businesses that already use other Zoho apps, the integration benefits are unmatched; you will feel like everything is working under one roof.

Zoho Books is not perfect, but it’s a solid, cost-effective choice for anyone who wants reliable accounting software that scales with their business. Whether you are just getting started or looking to streamline your current setup, Zoho gives you the tools to stay on top of your finances while focusing on what matters most: growing your business.

Yes, Zoho offers a free plan designed for small businesses, freelancers, and startups that meet certain conditions. For instance, the free version is available for businesses with revenue under a specific annual threshold (depending on your country) and provides essential tools like invoicing, expense tracking, and basic reporting.

In reality, there’s no difference; Zoho Books is the accounting software. Many people use “Zoho Accounting Software” as a general term, but the official product that handles accounting tasks is Zoho Books. That said, Zoho also has other financial apps, like Zoho Invoice or Zoho Expense, which integrate seamlessly with Zoho Books. When most people say “Zoho Accounting Software,” they are really talking about Zoho Books.

At its core, Zoho Books is an all-in-one platform for managing finances. It helps businesses handle invoicing, expense tracking, bank reconciliation, tax compliance, and financial reporting in one place. Business owners can also use it to automate tasks, such as sending recurring invoices or reminding clients about overdue payments.