Running a nonprofit is challenging enough; keeping track of donations, grants, and expenses should not feel like an uphill battle.

Yet many organizations still assume that the best accounting software for nonprofit organizations comes with a hefty price tag or complicated setup. The truth is, it’s just a myth. There are reliable options that are not only budget-friendly but in some cases completely free.

In fact, studies show that over 40% of nonprofits struggle with financial management, making the choice of the right tools even more critical. So, what accounting software do nonprofits use to simplify reporting and stay compliant? You might be surprised to learn that some of the most popular accounting software for nonprofits includes free or low-cost versions tailored for small teams.

This guide explores the best free bookkeeping software for small nonprofits and answers the common question: “Is there any free accounting software?” Yes, we have tested the top solutions to prove it.

By the end of this post, you will know exactly which free accounting software for nonprofits can save you time, reduce stress, and help your organization focus on what truly matters most, making an impact. Here is a quick review of the top 7 accounting software for non-profit;

| Software | Key Features | Pricing | Best for |

|---|---|---|---|

| Zoho Books | Track donations, Invoicing, expense tracking, donor management, financial reporting | Free plan available for small orgs under revenue threshold (paid plans start at $15/month) | Small nonprofits needing reliable, free bookkeeping software |

| Xero | Multi-currency support, donation tracking, 1,000+ integrations | Free trial, then from $29/month | Nonprofits that need scalability and global accounting features |

| FreshBooks | Excellent invoicing, time tracking, expense management | Free trial, then from $2/month | Nonprofits working with contractors or service-based projects |

| Patriot Accounting | Simple bookkeeping, payroll add-on, expense tracking | Starting Price $10/month | Volunteer-led or smaller nonprofits needing straightforward accounting |

| Sage Accounting | Strong reporting, multi-user access, integrates with donor systems | Starting Price from $17/month | Medium-to-large nonprofits seeking trusted, robust software |

| Puzzle | AI-driven bookkeeping, real-time financial insights, automation | Free Plan available, upgrade from $50/month | Tech-forward nonprofits wanting automation & modern finance tools |

| Precoro | Procurement management, expense approvals, grant spending control | Starting Price $499/month | Nonprofits managing grants, multiple vendors, or large purchase tracking |

Best Free Accounting Software for Non-profits

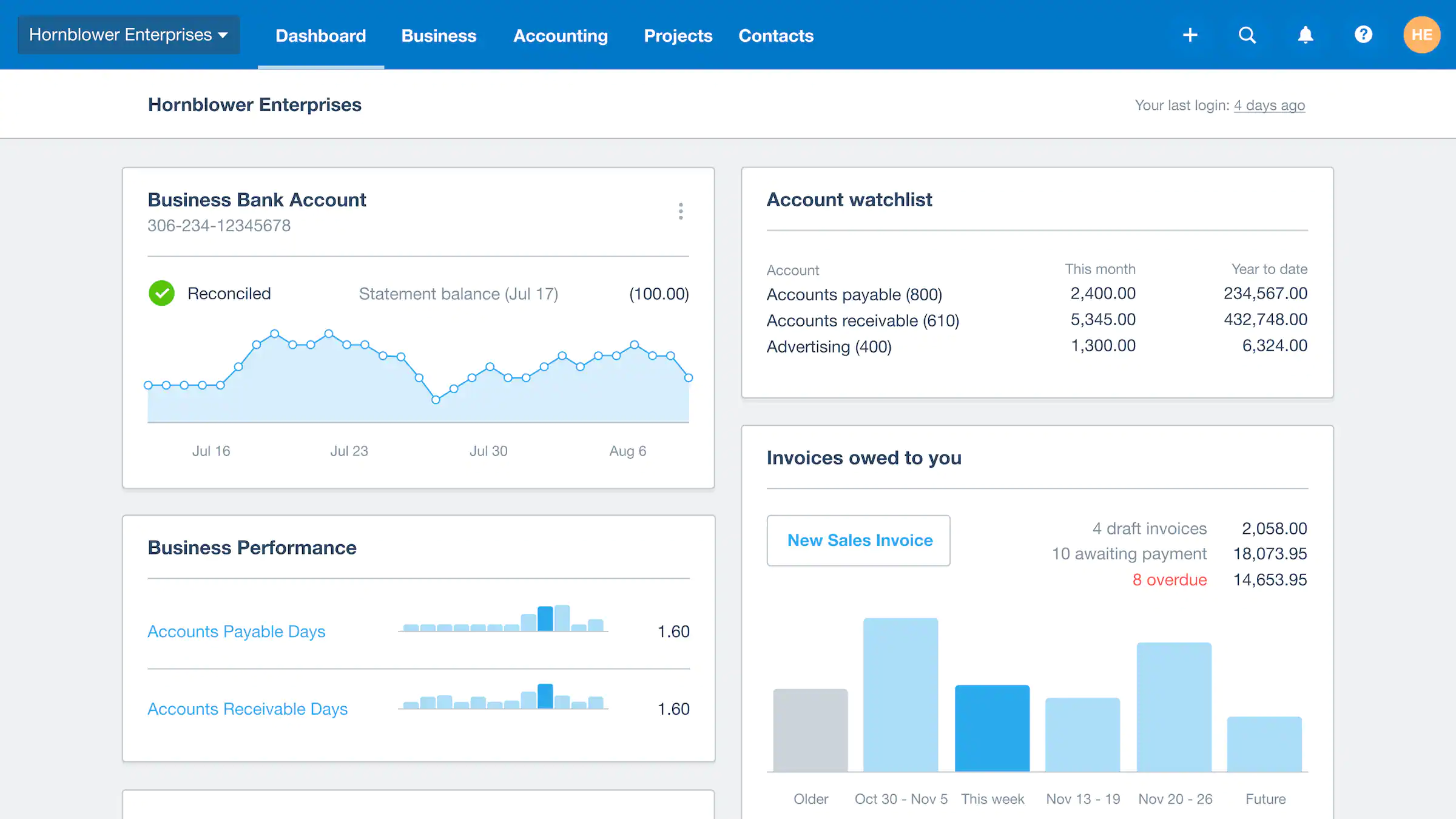

1. Xero for Non-Profit Organization

One of Xero’s biggest strengths is its multi-currency support. If your nonprofit receives donations or grants from international partners, Xero automatically converts and tracks them in real-time. No more headaches from fluctuating exchange rates or messy manual calculations.

Another game-changer is its integration library. With over 1,000 apps, you can connect Xero to donor management systems, payroll tools, or fundraising platforms. This means you’re not stuck in silos, your accounting stays synced with the rest of your operations.

Nonprofits also love Xero’s collaborative access. You can invite your treasurer, board members, or even an external accountant to view the books securely, without sending endless spreadsheets back and forth. It’s all cloud-based, so everyone stays on the same page.

And when it comes to accountability, Xero’s reporting tools let you create clear financial snapshots for your board or grant funders. Instead of scrambling at the last minute to justify expenses, you will have polished reports ready with just a few clicks. Think of Xero as an investment in peace of mind and credibility, two things no nonprofit can afford to overlook.

Pros and Cons of Xero for Non-Profit

| Pros of Xero | Cons of Xero |

|---|---|

| Multi-currency support makes it easy to handle international donations and grants | No permanently free plan (only a free trial) |

| Integrates with 1,000+ apps, including fundraising and donor management tools | Limited customer support on lower-tier plans |

| Highly scalable, works well for both small and large nonprofits | Some features require paid add-ons |

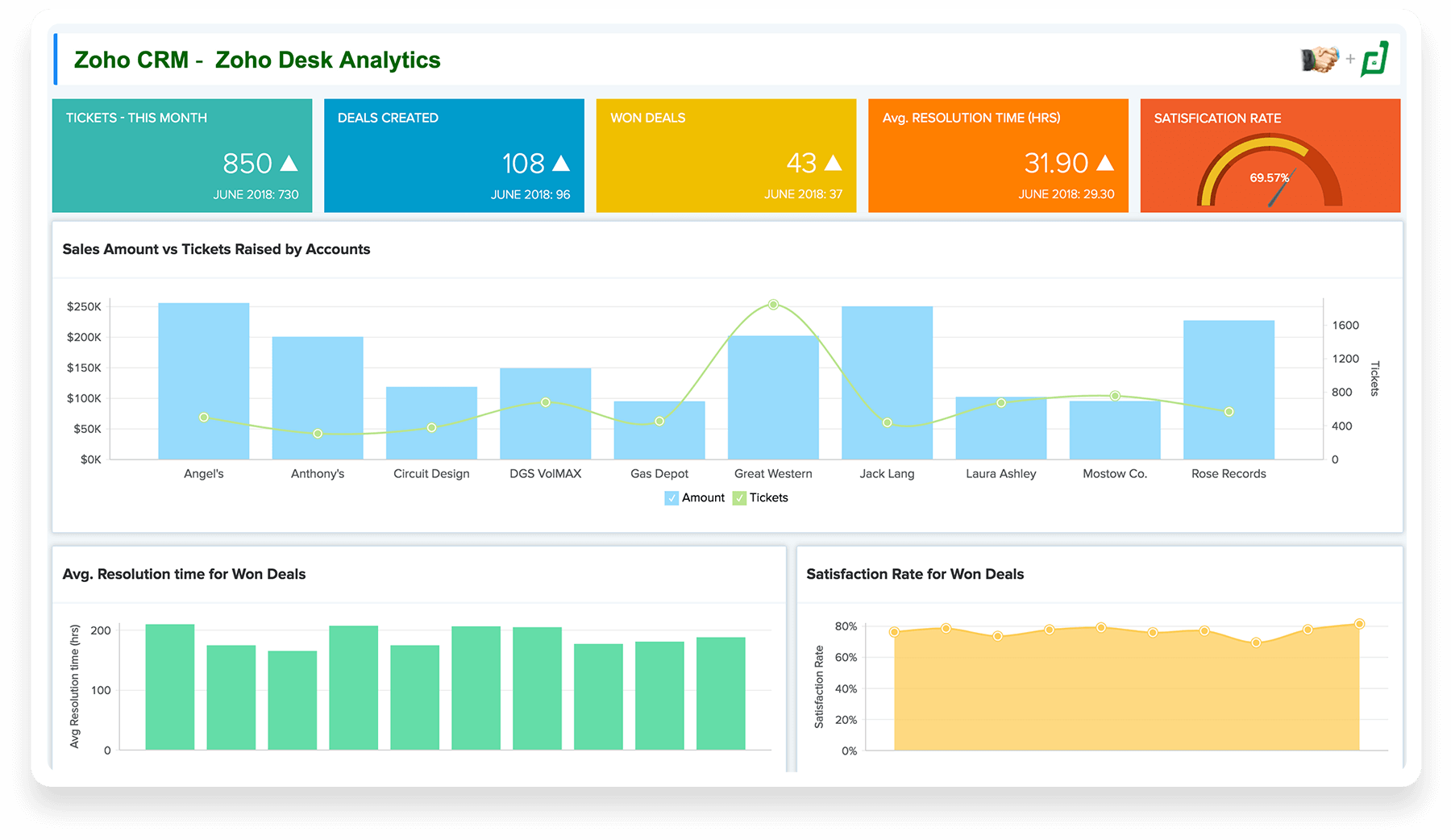

2. Zoho Books for Non-Profit Organization

If you are running a nonprofit, chances are you have a million things on your plate, including managing donations, tracking grants, paying vendors, and keeping the board updated with financial reports.

That’s where Zoho Books comes in. One of its standout features is automated invoicing and expense tracking. Instead of juggling spreadsheets or sticky notes, Zoho Books records every dollar that comes in and goes out, so you always know where your funds are going. For nonprofits that rely on transparency, this means you can easily demonstrate to donors exactly how their contributions are being utilized.

Another lifesaver is donor and contact management. With Zoho Books, you can tag and track different income sources, whether it is a grant, a membership fee, or a donation. No more mixing up who gave what or struggling to pull together year-end receipts for donors.

And let’s not forget reporting. Boards and grant funders often want regular financial updates. Zoho Books generates professional reports in a few clicks, saving you hours of manual work. That way, you can spend less time crunching numbers and more time focusing on your mission.

The best part?

Zoho Books offers a free plan for smaller organizations under a certain revenue threshold. That makes it an accessible option for nonprofits that don’t have big budgets but still need professional-level accounting.

Pros and Cons of Zoho Books for Non-Profits

| Pros | Cons |

|---|---|

| Free plan available for small nonprofits under a revenue threshold | Paid plan for growing nonprofits that exceed the free tier |

| Easy donor and income tracking, making it simple to separate grants, donations, and membership fees | May require some customization for nonprofit-specific reporting |

| Automated invoicing and expense tracking reduces manual errors | Payroll not included in the free plan |

3. FreshBooks for Non-Profit Organization

If your nonprofit runs on projects, whether it’s organizing community events, managing volunteers, or running outreach programs, FreshBooks can feel like a lifesaver. Its biggest strength is invoicing and payment tracking.

FreshBooks makes it super simple to send professional invoices, record donations, and even track recurring contributions. This means you will spend less time chasing payments or reconciling numbers and more time focusing on your mission.

FreshBooks also shines in time and project tracking. If your nonprofit relies on contractors, volunteers, or part-time staff, you can log hours against specific projects and see exactly where your resources are going. That kind of transparency is gold when reporting back to funders. On top of that, the expense management feature keeps every receipt organized.

Instead of digging through shoeboxes or random email confirmations, you will have a clear picture of your spending in one place. And when it’s time to talk numbers with your board?

FreshBooks’ easy-to-read reports break down income and expenses in a way that anyone can understand, even if they are not financial experts. its intuitive design makes it a great option for nonprofits that want a no-fuss system that anyone on the team can pick up quickly.

Pros and Cons of FreshBooks

| Pros | Cons |

|---|---|

| User-friendly interface that even non-accountants can navigate | No permanent free plan, only a trial |

| Excellent invoicing features, great for tracking donations or membership fees | Higher features available at higher price category |

| Clear, easy-to-read reports for boards and funders | Scalability may be limited for very large nonprofits |

4. Sage Accounting for Non-Profit Organization

Sage Accounting is worth a second look. One of its strongest features is robust reporting. Whether you need to show a grant provider exactly how funds were spent or provide your board with a year-end financial breakdown, Sage delivers detailed, accurate reports.

This level of transparency fosters trust with stakeholders and facilitates compliance. Another advantage is Sage’s integration ecosystem. It works well with other tools you may already be using for donor management, fundraising, or project tracking, so your financial system doesn’t operate in isolation.

Pros and Cons of Sage Accounting

| Pros | Cons |

|---|---|

| Robust reporting makes it easy to stay compliant and accountable | May feel too feature-heavy for very small nonprofits |

| Strong integration options with donor and project management tools | Slight learning curve for beginners |

| Scalable, works for both small and mid-sized nonprofits | Some advanced features are only in higher-tier plans |

5. Precoro for Non-Profit Organization

If your nonprofit deals with lots of procurement, vendor management, or grant-funded purchases, Precoro can be a real game-changer. Unlike traditional accounting software, it focuses on spend management, helping you control how money flows out of your organization.

One of Precoro’s standout features is its purchase order management system. Instead of scrambling to track receipts or emails, you can create, approve, and monitor purchase orders in one place. For nonprofits funded by grants, this ensures every dollar is accounted for, and compliance is never in doubt.

Pros and Cons of Precoro

| Pros | Cons |

|---|---|

| Strong purchase order management | No permanent free plan, only trial and paid options |

| Cloud-based with collaboration features for teams | Paid plans may be pricey compared to simpler bookkeeping software |

| Increases donor and grant compliance by tracking spending | Requires some training for new users to get comfortable |

6. Puzzle for Non-Profit Organization

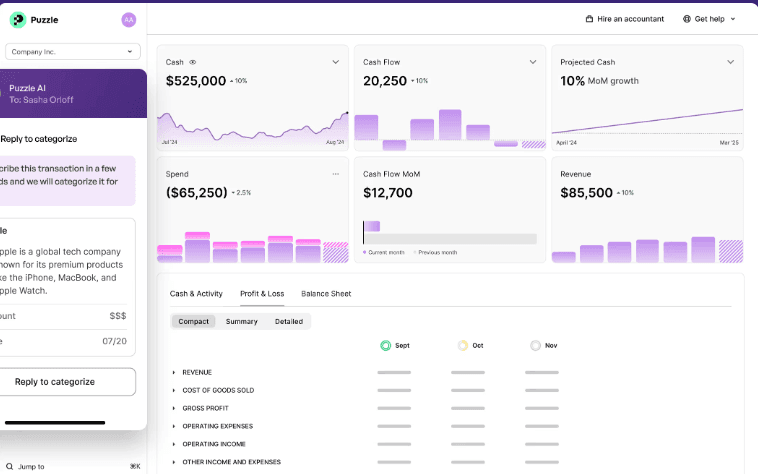

If your nonprofit wants to stay ahead of the curve and embrace new technology, Puzzle is an AI-powered accounting tool that brings automation right to your fingertips. One of its biggest strengths is real-time bookkeeping. Instead of waiting until the end of the month (or worse, year) to make sense of your financials, Puzzle automatically updates your books as transactions come in. For nonprofits, this means instant visibility into the remaining funding for a program or project.

Puzzle also uses AI to categorize expenses. So if your team is swiping cards for event costs, office supplies, or outreach programs, the software intelligently organizes everything, cutting down on manual entry and the errors that comes with it.

Pros and Cons of Puzzle

| Pros | Cons |

|---|---|

| AI-powered expense categorization reduces manual data entry | Not as widely used in the nonprofit sector (newer tool) |

| Clean financial dashboards make it easy to track cash flow | Limited Features for the Free Plan |

| Great for nonprofits embracing modern, automated systems | Limited nonprofit-specific integrations |

7. Patriot Accounting for Non-Profit Organization

Patriot Accounting is a breath of fresh air. Its biggest appeal is simplicity. You don’t need to be a finance pro to set it up or keep things running smoothly. With Patriot, you can easily track income and expenses, making it simple to separate donations, grants, and operational costs. This helps nonprofits stay transparent and avoid the chaos of trying to untangle different funding streams at year-end.

The platform is also cloud-based, so your treasurer, board members, or accountant can access the books from anywhere. No more passing spreadsheets back and forth; everything lives securely online. While Patriot doesn’t have a permanent free version, it offers a generous trial and budget-friendly pricing, which makes it a strong option for nonprofits that need reliability without complexity.

Pros and Cons of Patriot Accounting

| Pros | Cons |

|---|---|

| Very easy to use, even for non-accountants | No permanent free plan (only trial available) |

| Optional payroll add-on handles staff payments and tax compliance | May feel too basic for medium-to-large nonprofits |

| Cloud-based access for team collaboration | Limited integrations with other nonprofit or donor management tools |

Wrapping Up!

Managing finances should not distract your nonprofit from its mission, and the right accounting software can make all the difference. From Zoho Books, which offers a truly free plan for smaller organizations, to Xero and FreshBooks, which provide scalability and user-friendly features, there is a solution for every stage of growth.

If simplicity is your top priority, Patriot Accounting keeps things straightforward, while Sage delivers robust reporting and integrations for nonprofits ready to scale. For more innovative approaches, Puzzle brings AI-powered automation to the table, and Precoro fills the crucial gap of procurement and spend management.

So, what is the best choice? It depends on your nonprofit’s size, structure, and goals:

- Small nonprofits or volunteer-led organizations: Start with Zoho Books (free plan) or Patriot Accounting (affordable, easy to use).

- Growing nonprofits: Consider Xero or Sage for scalability, integrations, and reporting power.

- Project-heavy nonprofits: FreshBooks is ideal for managing contractors, events, or service-based projects.

- Modern and tech-forward nonprofits: Puzzle and Precoro complement your core accounting by automating and tightening financial controls.

No matter which path you choose, all of these tools have been tested and vetted with nonprofit needs in mind. The key is to pick a platform that saves you time, keeps your finances transparent, and frees your team to focus on making an impact where it matters most. Take the first step today.

Frequently Asked Questions

Yes! Tools like Zoho Books and Puzzle offer a free plan for small organizations under a revenue threshold. This makes it one of the best free bookkeeping software for small nonprofits. While most platforms like Xero, FreshBooks, and Sage do not have permanent free plans, they do offer affordable pricing and free trials, making them accessible options for growing nonprofits.

Completely free options are limited, but Zoho Books provides one of the most reliable free tiers. Some nonprofits also explore open-source solutions (though not on this list) if they want a 100% free tool without ongoing costs. For organizations ready to scale, affordable paid tools like Xero or Sage may be worth the investment due to their advanced features and integrations.